Apple has been slowly building out its financial services over the past few years. Following last month's launch of a buy-now-pay-later service, Apple will now let you set up a savings account connected to your Apple Card.

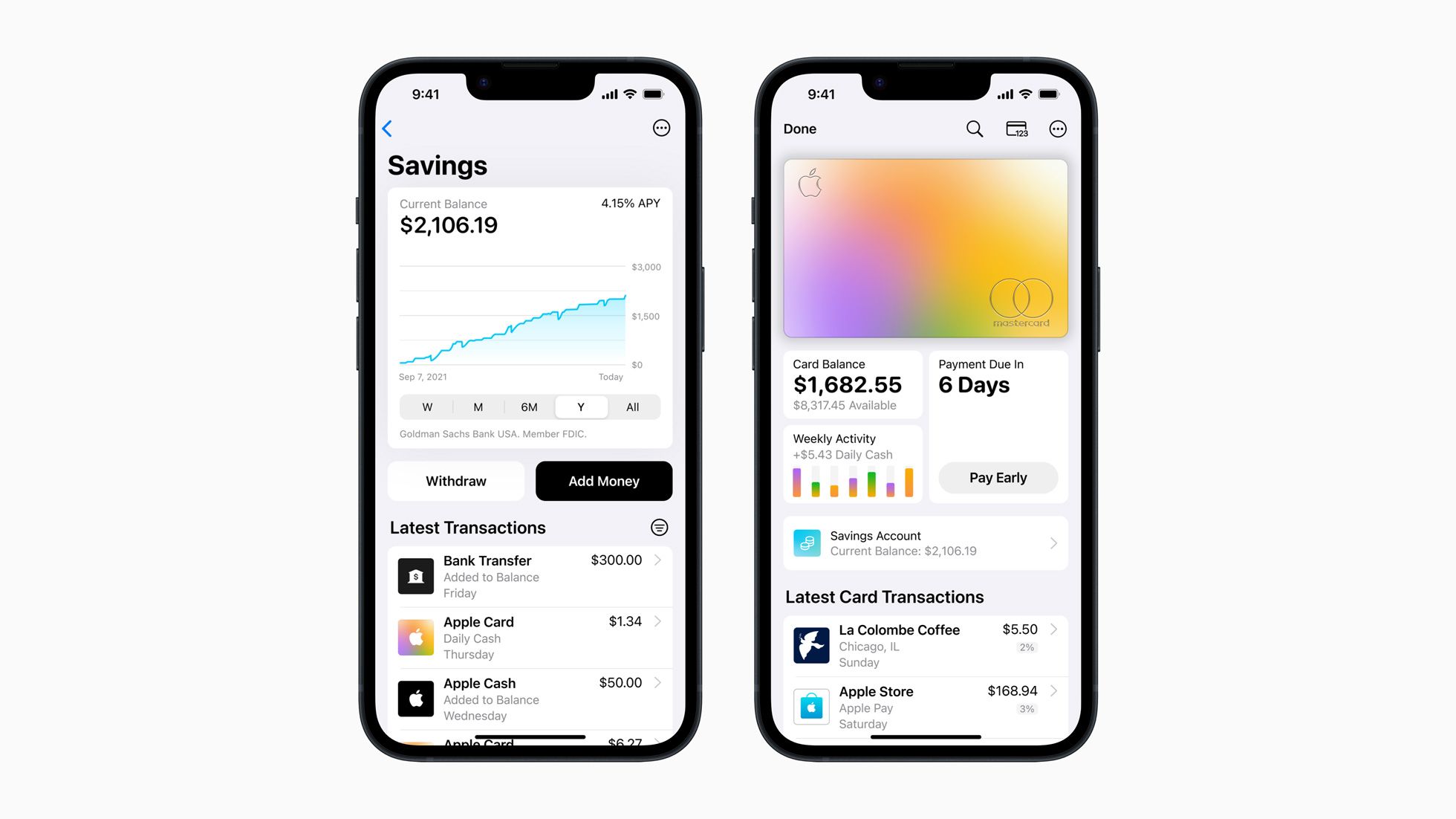

Apple now offers a savings account connected to Apple Card, and just like most of Apple's other financial services, it's operated by Goldman Sachs. You can set your Apple Card to deposit the card's cash back (or "Daily Cash") into the new savings account, instead of keeping it as a regular cash balance, and you can also deposit money from other accounts. The money from the savings account can be withdrawn to a separate bank account or your Apple Cash balance.

The new savings account has no fees, no minimum deposits, and no minimum balance requirements, and an annual interest rate of 4.15% -- well above the interest rates offered by most traditional savings accounts.

There are some limitations with the new savings account, though. According to the current account agreement, transfers to and from your account can't be more than $10,000, and there's a transfer limit of $20,000 per 7-day rolling period. You also can't use wire transfers or physical cash deposits, and Apple reserves the right to change the exact interest rate in the future.

The new savings accounts might be useful if you're already knee-deep in Apple's ecosystem, but just like with the company's other financial services, it's only accessible through Apple devices. There are other options for high-yield savings accounts that aren't locked down in the same way, such as SoFi's 4% APY accounts or T-Mobile Money, though they might have other restrictions.

You can sign up for a savings account from the Apple Wallet app. You need iOS 16.4 or later to get started.

Source: Apple