Quick Links

They are coming for you and your bank sooner than you think. And they have the potential to upend the way you transact and the future of cash as we know it. Meet "Central Bank Digital Currencies," or CBDCs.

CBDCs: Coming to a Country Near You

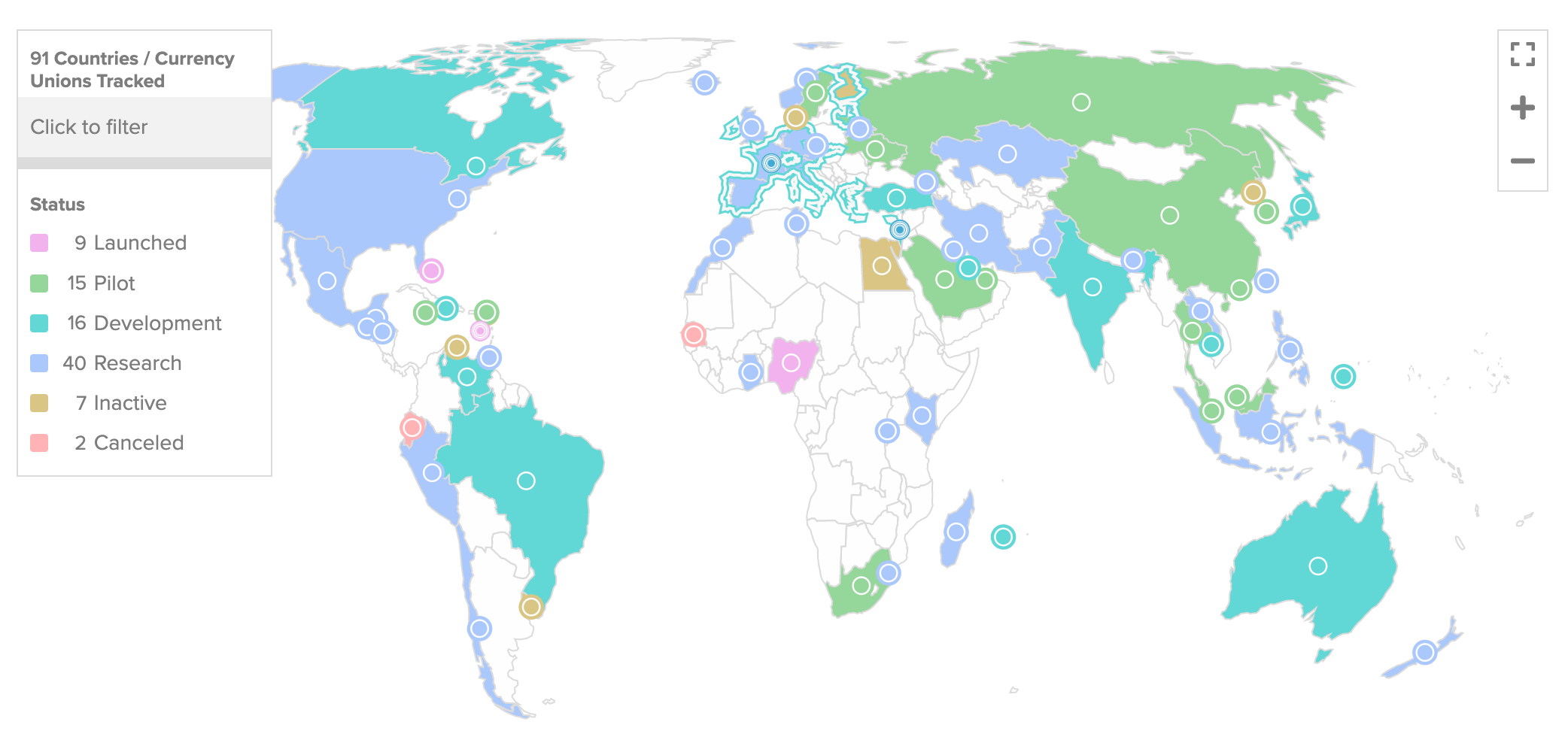

According to the Atlantic Council, an independent organization based in Washington, D.C. that tracks CBDCs, as of April 2022, 91 countries are considering issuing a CBDC. The Biden administration signed an executive order on digital assets on March 9, 2022 which contained a stipulation to research what a government-wide approach to deploying a CBDC would look like in the United States.

The important thing you need to know is that CBDCs are different from Bitcoin and other cryptocurrencies because they are created and governed by a centralized authority---in this case, a nation-state. You can make the case that many cryptocurrencies are also centralized, but there are many that fall on the spectrum of decentralization, and this is what makes them unique from our current legacy financial system.

All CBDCs are centralized by nature: the word "central" is even in the name. This means there's a small number of decision-makers controlling how the currency flows through the economy. This is similar to how the current financial system functions with groups like the Federal Reserve who are given the authority to set monetary policy.

It's also important to understand that not all CBDCs are created equal and nation-states will deploy them in a variety of ways, leading to significant implications for their citizens. The consequences of specific CBDC designs will play out in everyday society and culture. Let's explore some of the nuances of CBDCs so you are prepared for the coming revolution in government money.

What Is a CBDC?

A CBDC is a central bank digital currency. They are digital versions of a nation-state currency issued by the central bank of a given nation. They may or may not be backed by another asset or they may exist purely as fiat currency, which means the value is based on the promise of the government. Most major nation-states use fiat currency today and you could think of CBDCs as a digital version of fiat that has special unique additions in capabilities and functions because it's purely digital.

For example, in the US, a CBDC would essentially be a "digital dollar" and is often referred to as such.

Studies of how to apply CBDCs and begin issuing them are underway from several major nations across the globe. Some countries have already successfully launched their CBDCs, including Nigeria .

Often touted as the next evolution to replace cash as the dominant medium of exchange, hurdles remain before we see widespread adoption.

Government Issued & Owned

Governments like CBDCs because they are issued by the state and it allows for tight regulation within a closed system. CBDCs are under the direct control of the government unlike cryptocurrencies which are issued by the private sector or public blockchains

One concern of many governments is that cryptocurrencies offer populations a choice to opt-out of the traditional financial system into decentralized finance which exists beyond the typical oversight of government regulation. CBDCs are a way for governments to offer a digital payment competitor to cryptocurrency and decentralized financial systems being built outside of most current government regulation infrastructure.

It's appropriate to point out that money has not been under the control of a centralized authority for long in history. Just a couple hundred years ago, gold coins were accepted around the world without any central oversight. It is only in the last one hundred years that governments saw the immense power they could harness by establishing central banks to exert central authority of their economies.

Governments see CBDCs as a path to regain their monopoly on money because one of the best ways to control a population is through the economy. A vice grip on monetary policy is an important lever of control that governments are not keen on relinquishing, but questions remain about how quickly citizens of a certain country will adopt this new form of money like CBDCs.

Many factors could influence this arc of adoption. Adoption will likely vary greatly depending on the nation's existing political climate and system. Cultural differences may also make one nation more open to such evolutions in currency versus others that may be warier of these new technologies.

Let's remember that crypto is opt-in because you have the freedom to choose if you want to participate in the cryptocurrency and web3 economy. Nobody is making you download a crypto wallet and start trading NFTs or cryptocurrency tokens. It's entirely your own individual choice. It's critical to note that CBDCs may be opt-in---or they may become mandatory, depending on the laws and rules of a specific country.

Concerns With CBDCs

Inflation is still a legitimate concern because government central banks still maintain control over the monetary supply. There's nothing to stop a government from issuing more of its CBDC whenever it chooses or circumstances necessitate. In fact, it might be even easier to inflate CBDCs because they are entirely digital and it takes no physical inputs to create more of the currency. Just a few keystrokes and a government can create more money out of thin air.

Privacy is a major concern when it comes to CBDCs because CBDCs are inherently centralized. Centralization provides many avenues for corruption or abuse to occur, especially because CBDCs create massive treasure troves of data about who is paying who, and this could be harnessed to begin censoring certain transactions that the government deems unlawful or illegitimate.

If CBDCs are the only payment method by which one person can pay another, then the government has the power to block transactions or freeze your bank account whenever it chooses. Also, with all this data, it will be tempting for some governments to use it for surveillance over their populace.

CBDCs could be opt-in or could be mandatory. One example of a CBDC that is being built with surveillance as a priority is the Chinese Digital Yuan . The Digital Yuan aims to replace cash in Chinese society. China's digital yuan allows for the surveillance of all transactions across the entire financial system and China has the ability to remotely freeze accounts or block transactions that use the digital yuan.

The basic rights outlined in the Bill of Rights depend on economic freedom to be exercised. If economic freedom becomes more limited through the strict oversight of financial transactions using CBDCs, then fundamental rights become impinged and threatened.

Benefits of CBDCs

There are a range of benefits derived from some CBDCs, while others may offer limited benefits depending on their application. CBDCs are more cost-efficient than physical cash as they have lower transaction costs. It's much cheaper to send bits of data across the country than to pay for the security needed to transport large sums of cash as in the case of using armed guards and armored bank vehicles to pick up and deliver cash and other physical assets like gold bars.

The switch to digital currencies and the elimination of cash means everything is trackable so governments can ensure the security and integrity of their money supply with broad oversight and in-depth data on the intricacies of their economy.

One major benefit is that CBDCs can promote financial inclusion by allowing people who are often left out of the financial sector access to banking and other services. In many cases, all you need is a smartphone to get access to CBDCs. They can compete with private companies that need incentives to meet transparency standards and limit illicit activity.

How Will CBDCs Affect You?

A CBDC is virtual money backed and issued by a central bank. CBDCs are a government version of digital money but differ in some ways from cryptocurrency because they are always centralized whereas cryptocurrencies vary in their level of decentralization and central control. CBDCs could reach mass adoption and become part of daily life nearly as much as debit and credit cards.

As cryptocurrencies become more popular, the world's central banks have realized that they need to provide an alternative to compete in a world in which the future of money is already passing them by with new innovations launching every day. Decentralized finance (DeFi) and the use of stablecoins, which are cryptocurrencies pegged to a nation-state fiat currency like the US Dollar or the Euro, are examples of new possibilities happening beyond the guardrails outlined by the legacy financial system and its network of regulating agencies.

In some places, CBDCs could easily reach mass adoption and become part of daily life nearly as much as debit and credit cards. You may be forced to begin paying for official government dues in the native CBDC of a given government.

CBDCs will be adopted and deployed differently by various nation-states. It's crucial for governments that deploy CBDCs to enact them with care to preserve the rights of their populations and protect their data from overreach or corruption. Certain governments may lean into the control and surveillance opportunities that CBDCs offer and use them to further tighten their hold on power in their jurisdictions.

If you control the economic levers of a society, you can control the populace. There's no freedom without the freedom to transact: If a government censors your ability to transact, then it is limiting your right to free speech. Benefits of CBDCs include more ways that financial trends can be monitored and they can help monetary policy flow more quickly and seamlessly.

The most significant factors in determining the way CBDCs will impact your life depends a lot on where you live and how your country begins rolling out this next evolution in money.