Quick Links

It’s amazing how it’s become almost unthinkable to go about your day to day life without a fragile chunk of glass and expensive electronics in your pocket. A single drop, one stumble, a careless spill, and you’re out hundreds of dollars. This is why gadget insurance is such a big industry. But is it worth it to insure your gear?

Not all insurance is a good deal. If you’re not careful, you might end up paying a few dollars a month for a policy that doesn’t cover what you think it does. Let’s look at what you should check before you decide whether to insure your tech gear.

The Fine Print in the Contract Might Mean Something Different Than What You Think

Insurance is one of those things where you really need to look through the documents you’re signing. Ticking the “I have read the Terms of Service box” without looking over everything is a bad idea. While you might think you’ve insured your device for loss, theft, and accidental damage, the insurance company might have a different understanding of what those words mean.

Let's use AT&T’s $8.99 Mobile Insurance plan as an example. It offers “Coverage against loss, theft, damage, and out-of-warranty malfunctions.” That seems fairly standard but remember, other insurance offerings will be different. You can check out the Terms of Service document here.

Digging in, in section I. B., Coverage Plan, what’s covered is better defined.

[AT&T] cover your Covered Property for the following cause(s) of loss.

i) Physical damage.

ii) Theft, or loss by mysterious disappearance or other unintentional permanent loss of possession.

iii) Mechanical or Electrical Failure.

Other than the odd capitalisation on the last bullet point, so far, so good. The rest of the section points out that they don’t cover stuff you haven’t insured, your data, or accessories, and that your plan must be fully paid for in order to claim benefits.

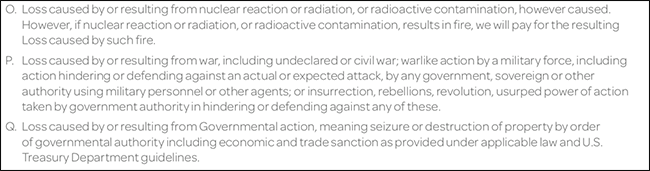

Section II. lays out the Exclusions. This is generally the most important section to check because it adds caveats to stuff like loss or theft. For example, if your phone gets damaged because of nuclear radiation (O.), a war (P.), or government action (Q.) it’s not covered.

There are also some more likely situations that are excluded.

B. Loss due to the intentional parting with the Covered Property by you or anyone entrusted with the Covered Property.

C. Loss due to the intentional, dishonest, fraudulent, or criminal acts by you or your family members…

Depending on how strictly the insurance companies decides to enforce these terms, stuff like leaving your phone on a café table while you run to the toilet could be considered “intentional parting” and, if your phone goes missing while you’re gone, you could be left uncovered. Similarly, if the person stealing your phone is your good-for-nothing brother, you might not be covered either.

All in all, AT&T’s policy really seems to cover you for what you think it does. There doesn’t seem to be anything here that is likely to trip you up. If your phone goes missing, gets stolen, or breaks, it looks like you’ll be alright.

So, let’s look at a policy where there are some terms defined in ways that could trip you up. I’m going to use my camera’s insurance policy. This is a professional policy and I pay around €500 ($600) a year for it. I’m covered for “theft,” but that comes with some caveats.

For my camera to be covered from theft, it either has to be in my “personal custody” or “in a securely locked building, hotel/motel room or hotel/motel safe and such theft or attempted theft involves entry to or exit from the building, hotel/motel room or hotel/motel safe by forcible and violent means”. If I leave my apartment unlocked and someone takes my camera, I’m not covered.

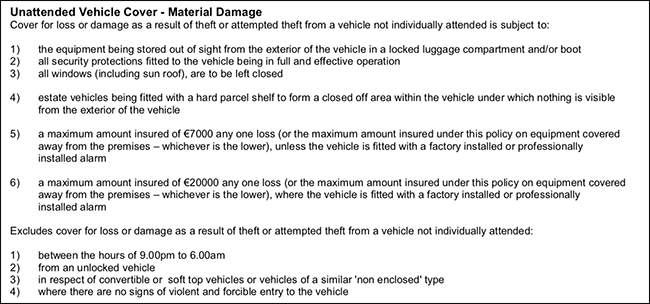

Similarly, if my gear is left unattended in my car:

- My gear must be stored out of sight in the trunk or a “locked luggage compartment”.

- The car has to be locked with “all security protections… in full and effective operation.”

- All the windows have to be left closed.

And even if all those stipulations are met, it’s not covered between 9pm and 6am.

These are’t unreasonable terms. The insurance company is just making it clear that I have a duty to look after my own gear and take reasonable precautions to protect it. However, if I hadn’t read the policy, I wouldn’t have known about the 9pm to 6am vehicle exclusion.

You Have to File a Claim Using the Official Process

Most insurance policies will have a section where they list your duties in the event of a loss or theft. Again, they aren’t overly onerous, but you need to make sure you do them. Back to AT&T’s policy. Section VI lays out your duties. The four most important terms are:

A. In the event that your Covered Property is lost or stolen, you must notify your wireless service provider as soon as possible to suspend service.

B. If a claim involves a violation of law or any loss of possession, you agree to promptly notify the law enforcement agency with jurisdiction and obtain confirmation for this notification.

C. You must report the Loss promptly to our Authorized Representative not later than sixty days from the Date of Loss…

F. If the cause of Loss is not loss or theft, you must keep the Covered Property until your claim is completed…

All this means is that to make a claim, you need to call your carrier straight away; that if your phone is stolen you have to go to the police and if it’s not, you have to keep a hold of it; and you can’t file a claim six months later.

The Deductibles Can Be Enormous if Your Device is Lost or Stolen

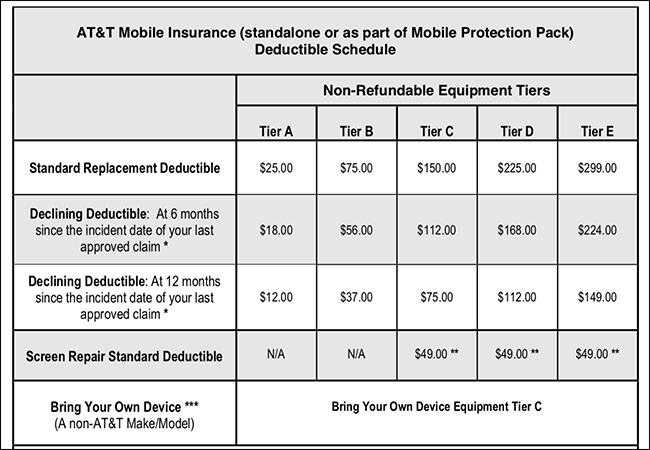

Almost all insurance policies come with a deductible. This is the amount of money you need to pay every time you make a claim in addition to the monthly fee. In general, the lower the monthly amount, the higher the deductible. Even plans that boast that they have no deductible, often have a mandatory administration fee for every claim.

The problem with deductibles is that they can be quite high. Let’s imagine you buy an iPhone X and insure it with AT&T’s Mobile Insurance policy at $8.99/month. Over your two year contract, you’ll pay $215.76 for the insurance. Not too bad. However, if your phone gets stolen and you need to make a claim, you’ll have to pay between $149 and $299 for the deductible. For screen repairs, the deductible is only $49.

If you’re prone to losing or breaking your phone, this might still be good value. But $300 is not a small sum to pay in one go. Lose your phone and break one screen, and suddenly your insurance policy is costing you in the region of $500 for the year. You might be better off with a cheaper phone or at least learning how to take better care of the one you have.

Should You Insure Your Tech Gear?

I don’t insure my iPhone since I’ve never lost a phone and have only broken a single screen. It’s just not worth it to me. If you’re good with phones and don’t lose or break them, the numbers just don’t add up.

On the other hand, if you regularly break your stuff, you might be better with something like AppleCare+. You get cheap repairs and it costs less than most insurance plans. It’s also included in the iPhone Upgrade Program.

Insurance really only works out for people who lose their stuff or for things that are incredibly expensive to replace---like your home. If you can’t go out for a night out without misplacing your iPhone, then insurance is probably for you. You’ll end up paying a fortune in deductibles, but you’ll probably come out a little bit ahead.

Image Credits: Cytonn Photography on Unsplash, Bruno Nascimento on Unsplash.